Reuters

Dec 1, 2016

Hong Kong malls bet on local demand to ride out sales slump

Reuters

Dec 1, 2016

Hong Kong mall operators and retailers, plagued by a prolonged slump in sales, are now digging deep in to the local market to revive their business that has slowed due to a plunge in the number of visitors from mainland China.

Chinese-controlled Hong Kong was once a favorite shopping destination for mainland tourists, but the numbers have dwindled since 2014 amid Beijing's campaign against graft and shows of wealth by public officials. Pro-democracy protests in Hong Kong have hurt too, while a firm local currency HKD=D3 means luxury goods are cheaper elsewhere such as in Japan and South Korea.

Hong Kong's retail sales fell for a 20th month in October to HK$36.1 billion ($4.65 billion), down 2.9 percent from a year ago. The drop, however, narrowed from a 4 percent slide in September and 10.5 percent fall in August.

Hong Kong's retail market is small in comparison to the broader mainland market, but remains a barometer for luxury spending as it has been a key hub for international brands.

"The big hole left by the mainland's big spenders is not easy to fill by local consumption all of a sudden," said Linus Yip, chief strategist at First Shanghai Securities. "Boosting local consumption is among the things they can do and is within their control for the time being."

To attract domestic buyers, Kerry Properties' MegaBox mall in Kowloon has created a game zone that allows shoppers to interact with festive props like a Christmas tree using virtual and augmented reality.

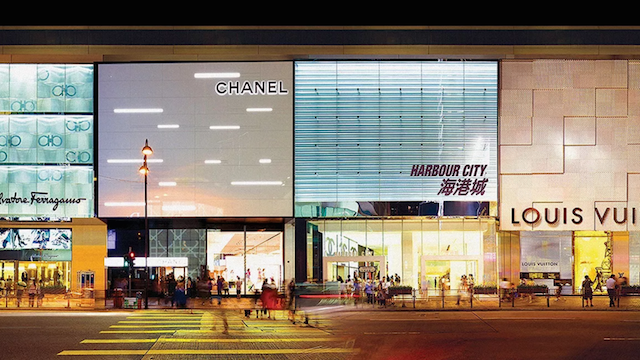

The Wharf's Harbour City mall has resorted to festive lighting in Tsimshatsui, while Sino Land's Olympian City has launched a Christmas circus based on the animation film "Madagascar" to lure family shoppers.

Sun Hung Kai Properties has set aside HK$38 million for promotional activities over Christmas across its 10 major shopping malls in the city, up 10 percent from a year ago.

"Apart from a loyalty and VIP programme, we have adjusted our tenant mix and are adding more food and beverage variety to draw in more local shoppers, while events including popular animation characters attract families," said Fiona Chung, general manager (Leasing) of Sun Hung Kai Real Estate Agency.

FEWER TOURISTS HURT SALES

The push to attract local buyers comes at a time of weak tourist arrivals, which fell 2.4 percent from a year earlier in October, according to the Hong Kong Tourism Board, bringing the drop to 5.7 percent over the first ten months.

Mainland China visitors, who account for 75 percent of the total, fell 3.5 percent in October.

Fewer tourist numbers were reflected in weak retail sales for companies such as Swire Properties, which saw a 15.3 percent drop at The Mall in the Central business district in Pacific Place over January to September. Tourist-dominated Citygate Outlets on Lantau posted an 11.2 percent drop.

China's biggest jeweller Chow Tai Fook Jewellery, and smaller rival Luk Fook Holdings posted sharp drops in fiscal first-half profit.

"We will continue to attract customers and boost local consumption by enhancing product displays, cross promotional campaigns and VIP promotional activities so as to improve sales and profit," Luk Fook Chairman Wong Wai-sheung said.

© Thomson Reuters 2024 All rights reserved.